Procedures for registration to use electronic invoice information...View more

What is the procedure for restoring a locked tax code?...View more

The sanctioning measures for violations concerning the deadlines for tax registration, notification of temporary suspension of business operations, and early notification of business resumption are stipulated in Decree No. 125/2020/ND-CP...View more

"Investors who participate in trading international securities on platforms not organized and operated by the Vietnam Stock Exchange and its subsidiaries should exercise utmost caution, particularly with regard to solicitations promising high interest rates or returns that lack transparency. Investors are advised to be vigilant when receiving invitations to invest in international stock or derivative trading platforms." This is a warning issued by the State Securities Commission of Vietnam in light of the increasing number of individuals engaging in investment channels that are not recognized under Vietnamese law....View more

Can Vietnamese people directly buy and sell securities abroad? Can profits from overseas investment be used to implement new investment projects?...View more

In what cases is a foreign-invested project a project? What are the principles for supervising and evaluating foreign investment activities?...View more

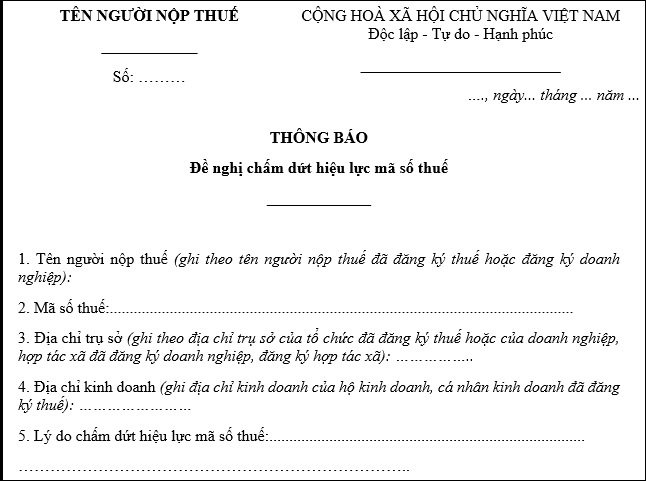

Clauses 1 and 2, Article 39 of the Law on Tax Administration 2019 stipulates the cases in which taxpayers can have their tax codes invalidated....View more

Can businesses allocate corporate income tax to areas with representative offices that only have trade promotion functions?...View more

A Vietnamese commercial bank can have a maximum number of foreign individuals owning 5% of its charter capital?...View more

What is overseas investment?...View more

_20240409_165902.jpg)

_20240409_165030.jpg)

_20240409_163555.jpg)