Does the lessee who subleases the house to a third party have to send a written notice to the lessor?...View more

What are the conditions for organizations and individuals when doing real estate business according to the latest regulations?...View more

Can project land that is not implemented be rented out for warehouses and factories?...View more

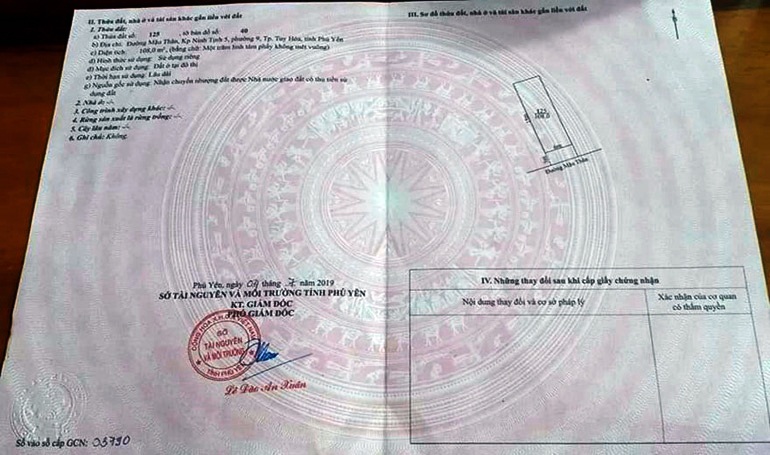

In many cases, land buyers often ask the question of whether buying land but the Red Book is still in the name of the old owner, only notes that it has been transferred, and if a new book is not issued, will it affect the rights and interests of the buyer? ? Let's read the article below to clarify this issue....View more

Land use rights and housing ownership are strictly regulated in the Land Law. Below are the regulations on conditions for Vietnamese residing abroad to buy land:...View more

Vietnamese people residing abroad are one of the land users prescribed by law. Below is a specific article on regulations on land use rights of Vietnamese people residing abroad?...View more

Nowadays, many people are concerned about whether they should give the red book to their child or inherit it. Each form of transferring the name of a red book to a child by inheritance or gift has its own advantages and disadvantages that parents need to clearly understand when choosing to make a safe choice when transferring the name of a red book to their child. So when transferring the name of the red book to your child: Should it be given as a gift or an inheritance?...View more

Land is owned by the entire people and the state represents the owner. The state will grant land use rights to land users according to the provisions of law. Below are some cases that will not be allowed to receive gifts of land use rights that need to be complied with....View more

Due to many different reasons, the actual investment project implementation process may be delayed compared to the original plan. So can an investment project continue to be extended if that investment project has been delayed many times?...View more

Income from real estate transfer includes many types of income such as transfer of land use rights, land lease rights, transfer of houses, construction works and assets attached to land. In particular, income from land sublease activities of real estate businesses is also included in taxable objects....View more